Trading Strategy

Consider the following possible strategy. Begin by creating a list of symbols that if stuck owning shares of that symbol, its not overly concerning. After creating the list of symbols, determine the purchase price target of each symbol based on various important criteria (such as P/E, dividend yield, price history, etc).

Now with a symbol list and price targets established, review PUT option prices on strikes that are at or below each price targets that expire in the next 1 - 8 weeks for each symbol.

There are two possible outcomes when selling a PUT contract:

- The price of the underlying symbol stays ABOVE your contract's strike and the contract expires worthless resulting in NOT having to purchase 100 shares of the underlying at your strike price per share.

- The price of the underlying symbol drops BELOW your contract's strike and the contract is assigned, resulting in having to purchase 100 shares of the underlying at your strike price per share.

The first case is the preferred outcome because the process can be repeated again while still keeping your full investment in cash as well as the premium collected from the sale of the put contract.

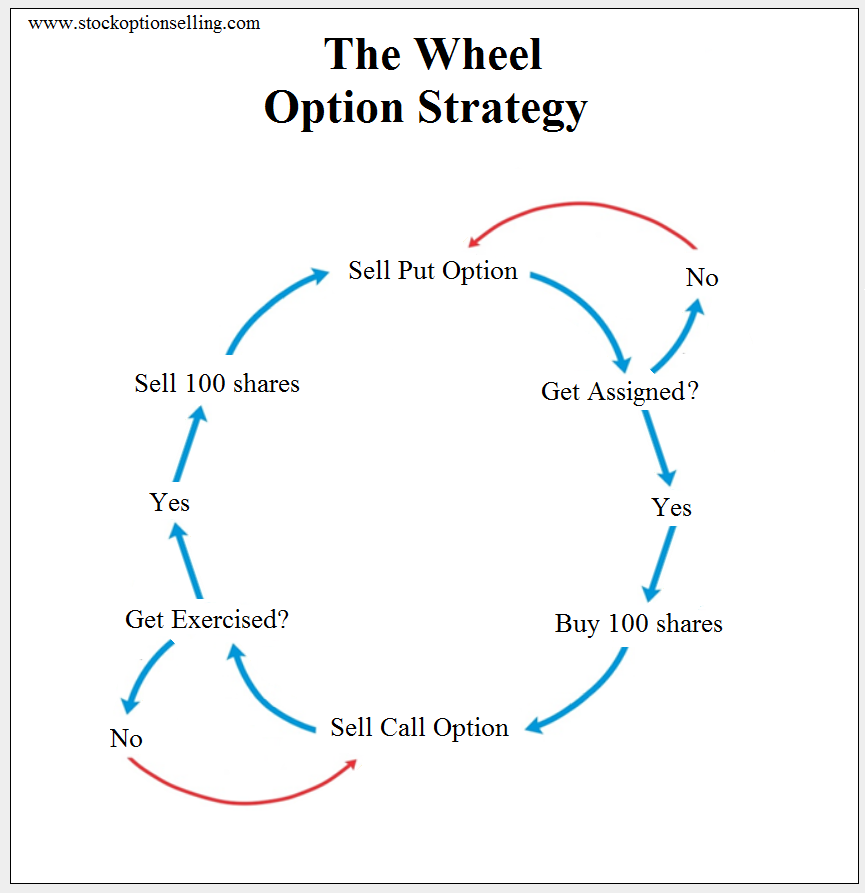

The second case is less ideal because now shares of the symbol were purchased above the current price and the market price could continue to drop. This is why it is important to sell PUT contracts ONLY on quality companies (symbols) at a good price. Some individuals like companies that have a good dividend history and dividend yield because that usually helps prevent the stock from dropping too far. Worst case simply hold the stock and collect the dividends. One thing to remember is that when owning shares of stock, an account immediately loses money for every penny the stock drops. However, when selling a PUT option contract, the stock has to first drop to the strike price before losing money. As a result, if getting assigned a PUT contract and required to purchase 100 shares, consider aggressively looking to sell a CALL contract at the same strike the stock was purchased and hopefully get the shares called away as soon as possible to prevent it from having a chance to produce further losses. Furthermore, look to sell a call IMMEDIATELY to collect some premium to help reduce further downside risk. Once able to get the shares called away via a CALL option, go back to selling a PUT contract. Notice this is a circular process and is commonly called "The Wheel Strategy".

After learning the basics of put and call options, most people realize the input of one is the output of the other. As a result, the two option types can be used together in a simple continuous cycle, referred to as "The Wheel".

Option Alpha did a podcast discussing this strategy.

This is a great strategy because it is simple and forces the successful investment principle of buying low (selling a put)

and selling high (selling a call).

Possible General Rules

-

When selling put option contracts:

- All puts should be cashed secured puts, which are puts where the option seller has enough money to buy the 100 shares if the contract is used/exercised.

- The best time to sell puts are on days when the stock price is down.

-

When selling a call option contacts:

- All calls should be covered calls, which are calls where the option seller owns 100 shares.

- The best time to sell calls are on days when the stock price is up.

-

Don't be greedy. Making a little money is better than losing money.

- Try to close option contracts early for a fraction of the profit after earning a majority of the profits.

- Close out earnings trades ASAP because there have been many instances where winning trades have quickly changed to losing trades.

-

Don't be too risky. Try to keep your portfolio in cash and cash secured puts, as this is the least risky of all option strategies.

- When getting assigned stock from selling a put, don't wait to review call options waiting for the price to go up because the price may go down more.

-

Only sell cash secured puts on stocks/etfs that meet ALL of the following criteria:

- The stock/etf has options that are liquid/popular. Usually this is the case if it has options that expire weekly.

- The stock/etf is something that the individual wouldn't mind owning (because the stock may make an unexpected big move and you will be assigned sometimes even at a strike price that seemed impossible to reach).

- The strike price is at a "good price".

-

Look to sell contracts with more than 30 and less than 55 days remaining until expiration for optimal time decay.

- Contracts that don't expire for more than 7 days should NOT include an earnings event. Either wait until after earnings or select the expiration date before earnings.

-

For earnings trades, sell puts in the later afternoon prior to the earnings announcement.

- When getting filled, consider immediately setting up a good til cancelled (GTC) closing order for $0.01 to get out of the trade when the market opens the following day.

-

If owning increments of 100 shares, never execute a sell order. Instead, sell a call option aggressively

- Adding the premium collected to the strike price gives the actual sell value, which is likely always higher than selling outright (even if its deep in the money).

Recommended Podcast Episodes

1) Double Dividends Stocks

2) Richard Berger

3) Option Alpha - Wheel Strategy

4) Option Alpha - Interview with Cameron Skinner